Why It May Be Time for Health Systems to Restructure their Physician Enterprises

The median loss per physician employed by a hospital or health system totaled more than $249,000 in 2023. Now, as hospitals face their biggest financial crisis ever, hospital leaders must consider: “Is there a better structure for our physician enterprise?”

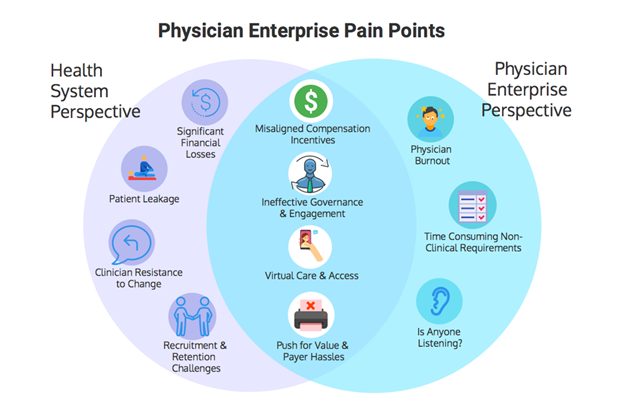

The pain points that hospitals and physicians experience under an employed physician enterprise model are well-known (see the exhibit below). To optimize physician enterprise performance, hospital leaders must address these pain points and align incentives and goals.

An effective structure should engage physicians, reduce losses, avoid leakage, deliver high value, reduce burnout, improve quality, and support value-based payment models. As not-for-profit hospitals face a negative financial outlook, this might be the right time to tackle a sacred cow, and restructure the physician enterprise.

Envisioning a New Organizational Structure

Imagine a new organizational structure for the employed physician enterprise—one in which physicians remain aligned with the hospital/health system but operate with greater independence and responsibility for overall financial performance.

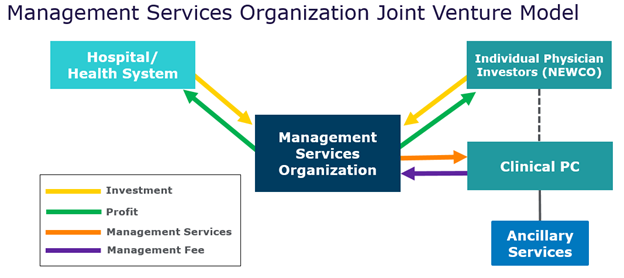

One vision for the physician enterprise in 2024 and beyond is a model similar to private equity arrangements with physicians. It separates the hospital physician enterprise into a clinical practice and management services organization (MSO). Under this type of model, the MSO is designed to be profitable with growth via management services agreement fees set at fair market value. The clinical practice pays the MSO—which the physicians and the hospital own together—to manage the practice. Then, the physicians receive a share of the profits from the MSO on top of their compensation.

It’s a structure that not only has the potential to address the top pain points hospitals and employed physicians experience under existing physician enterprise structures, but also becomes an investment vehicle which younger physicians could buy into over time, similar to the structure for accounting and law firms. The model also provides for buyout of equity over time—providing a long-term wealth-building mechanism for physicians.

One depiction of this new model for governance appears below.

To transition to this model:

- Established physician leaders form a new company (“NEWCO”), which, in turn, forms a joint venture MSO with the hospital.

- The hospital sells a meaningful minority stake in the MSO, which is financed via equity and hospital loans.

- The clinical practice could be jointly owned and governed by a hospital physician CEO/Chief Medical Officer and an “independent” physician CEO.

- The MSO is initially capitalized via hospital debt and a working capital line of credit.

- The clinical practice and the MSO are structured so that physician compensation and the management services agreement fees are aligned and consistent with fair market value.

This type of restructuring model is similar to the operating structure that private equity firms use when employing physicians. In fact, the models described above also could be used by hospitals and physician groups to partner with private equity firms in operating the MSO—a move that would provide an additional source of capital for the MSO. The MSO also could partner with a practice management company to operate the MSO, and the practice management company could choose to invest in the MSO.

What’s in it for the physicians?

For primary care physicians, a model such as this can more effectively support the pursuit of a value-based care strategy, with payer incentives supporting higher compensation. For specialty practices, hospitals and systems would need to allow the MSO to develop some ancillary services. This would reduce hospital ancillary revenue, but the lost revenue may be offset by reduced losses on the physician enterprise. Looking ahead, if Medicare pursues its stated intent to eliminate the higher ancillary payment rates for hospitals, physician-owned ancillaries would be paid at the same rate, eliminating one of the historical reasons for hospitals keeping ancillary services.

A Future-Focused Model for Physician Alignment

There are challenges to implementing a model such as this, but the benefits could hold strong appeal for physicians and hospitals alike. For physicians, this type of model could provide greater self-governance while appealing to their entrepreneurial spirit. For hospitals, it’s an opportunity to eliminate losses on physician practices, and could provide a model that competes with private equity-backed groups that may woo specialists. In 2024 and beyond, exploring ways to restructure the physician enterprise, including through a model such as this, could establish a more sustainable aligned physician network.

Contact the Authors:

Daniel Grauman, Managing Director & CEO, dgrauman@veralon.com

John Harris, Managing Director, jharris@veralon.com